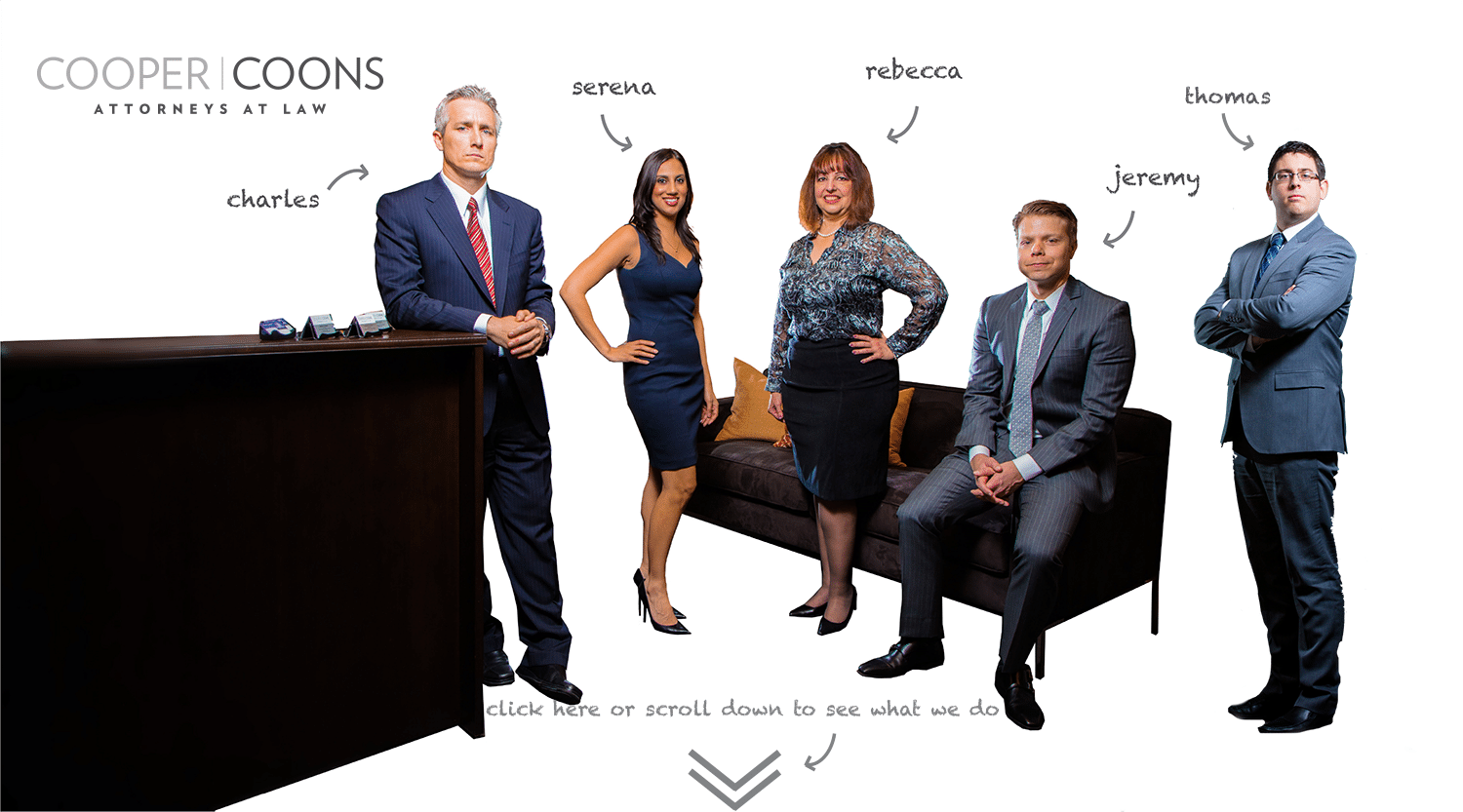

Charles Coons

Charles Coons focuses his legal practice on patent prosecution and counseling, advising his clients on intellectual property and cyber law matters. Charles is also an expert in copyright and trademark law, in addition to estate planning, asset protection, and probate. After completing his Bachelor of Science at Brigham Young University, Charles ventured to New York City and experienced the entrepreneurial excitement and energy of the late 90’s dotcom boom. During this time, Charles worked for an Internet startup that developed a novel approach to medical device distribution. Later that year, Charles was asked to join a telecommunications startup that developed and deployed one of the First optical networks within the New York City limits. In 1999, Charles was recruited to join the telecom giant, AT&T, as a senior network and computer engineer. Charles spent the next ten years with AT&T in various engineering positions, in addition to leading and participating in numerous developmental teams with AT&T Labs. These developmental experts exposed Charles to the legal landscape of patents and intellectual property. Charles continued to foster his interest in intellectual property by returning to his hometown of Las Vegas to attend law school. Charles earned his Juris Doctorate (JD) Degree from the William S. Boyd School of Law in 2007. After graduation, Charles continued to work as an independent engineering consultant with AT&T, while broadening his legal experience as an associate in a Las Vegas general practice Firm, where he led the intellectual property team. In 2008, Charles earned his patent lawyer registration with the United States Patent and Trademark Office. Charles then sharpened his intellectual property expertise by accepting the assistant general counsel position of a startup media company that focused on copyright protection for major publishing enterprises. While serving as the assistant general counsel, Charles filed over 300 copyright registrations and litigated in excess of 150 Federal Court actions for copyright infringement. In 2010, Charles became a partner at COOPER | COONS, Ltd. Charles is barred in Nevada.[email protected]

skype.com/jccoons

Jeremy Cooper

Jeremy Cooper is a partner with COOPER | COONS, Ltd. Jeremy’s practice is focused on estate planning, asset protection, trust administration, probate, and any matters related to these areas of law. Jeremy graduated with a Bachelor of Science in Accounting from Brigham Young University (Cum Laude and Phi Kappa Phi). Following the completion of his undergraduate studies, Jeremy continued his education at BYU where he earned a Master's Degree in Accounting with an emphasis in Taxation. Upon graduating from BYU, Jeremy worked as a senior associate with PricewaterhouseCoopers, LLP’s (PwC) corporate tax group in Silicon Valley. After spending several years in public accounting and becoming a licensed CPA, Jeremy returned home to Las Vegas, Nevada, to pursue his longtime goal of attending law school. Jeremy earned a Juris Doctorate (JD) Degree from the William S. Boyd School of Law. While a JD candidate, Jeremy was selected to serve as senior staff member of the Nevada Law Journal. Jeremy began working as a law clerk for Jeffrey Burr, Ltd. after completing his first year of law school and remained employed there until partnering with Charles Coons to form COOPER | COONS, Ltd. While at Jeffrey Burr, Ltd., Jeremy was able to provide valuable estate planning and asset protection to a range of clients in a variety of circumstances. Jeremy is currently a member of the Nevada Society of CPAs and the Southern Nevada Estate Planning Council. Jeremy also serves on the UNLV Planned Giving Professional Advisors Council, the College of Southern Nevada Planned Giving Council, and the Goodwill of Southern Nevada Audit Committee. Jeremy speaks Spanish fluently and has been able to provide estate planning and asset protection services to many Spanish speaking clients over the years. Publications:- “Revisiting 2010: IRS Finally Publishes Guidance on Filing Form 8983,” Silver State CPA, September 2011.

- “Preventing Fiduciary Liability – Investment Rules And Decision Making,” Trust Administration: Preventing and Litigating Fiduciary Liability, National Business Institute Continuing Legal Education for Professionals Manual, Copyright 2011.

- “Nevada Laws Provide Top Trust Situs,” co-authored with David M. Grant, Nevada Lawyer, May 2010.

- “A Refresher on Grantor Trusts and Their Income Tax Filing Options,” Silver State CPA, September 2009.

- “Nevada Takes the Lead: Charging Order Protection is Now Available for Small Corporations,” co-authored with David M. Grant, Communiqué, May 2009.

- “Charging Order Protected Entities and Their Role in Wealth Preservation,” co-authored with Jeffrey L. Burr, Journal of Financial Service Professionals, May 2009.

- National Grand Prize Winner for Graduate Level Paper Essay Contest sponsored by American Association of Attorney-Certified Public Accountants: Compare and Contrast the Similarities and Differences Between Retained Earnings as Calculated under Generally Accepted Accounting Principles and Earnings and Profits as Calculated for Federal Income Tax Purposes.

- National Third Place Winner for Graduate Level Paper Essay Contest sponsored by Attorney-Certified Public Accountants: Compare and Contrast SEC/PCABO and AICPA Rules and Philosophy on Independence for the Attestation Role including its Attribution to the Practice Entity and Other Professionals Therein.

- “Year-end Estate, Gift, and Generation Skipping Transfer Tax Planning: The End of an Era?,” co-authored with JeremyK. Cooper, Silver State CPA, December 2012.

- “The Laws and Rules Governing Trustees and Non-Monetary Aspects of Trust Administration,” Fundamentals of Trust Administration, National Business Institute Continuing Legal Education for Professionals Manual, Copyright 2012.

[email protected]

skype.com/jeremycooper24

Rebecca Hopkins Miller

Rebecca is an attorney with COOPER I COONS, Ltd. and head of its Family Law Department. Rebecca has been involved in the practice of Family Law in Las Vegas, NV since 1987 and works in the areas of Domestic Relations and Mediation. At the time Rebecca passed the Nevada State Bar in 1986, she was employed as a judicial law clerk for, Michael J. Wendell, District Court Judge, Clark County, Nevada. Rebecca has previously served as an Executive Board Member of the Family Law Bench-Bar Committee, committee member on the Disciplinary Panel of the State Bar of Nevada for 9 years and is currently a Platinum Member of the Las Vegas Social Register. She was also a member of the Executive Council of the Family Law Section of the State Bar of Nevada for 8 years. Currently, Rebecca is a member of the Outsource Mediation Committee, the Outsource Child Custody Evaluation Committee, and a board member of Collaborative Professionals of Nevada. Rebecca’s employment background includes having been the head of the Family Law Department of the Alverson, Taylor, Mortensen, Nelson and Sanders Law Firm for more than 8 years and a partner with the Schofield Miller Law Firm. Rebecca is a member of the State Bar of Nevada and the Clark County Bar Association. She accepts cases in the areas of Family Law, defense of attorneys required to appear before the Disciplinary Board of the State Bar of Nevada, and is an Arbitrator for the Clark County District Court in the area of negligence cases. Rebecca is very active as an arbitrator and mediator primarily in the area of Family Law, as well as having been trained as a Collaborative Divorce Law Practitioner 9 years ago, of which there are only approximately 25 such trained attorneys in the State of Nevada. Rebecca was born and raised in Las Vegas, Nevada. She attended the University of Nevada Las Vegas, where she obtained a Bachelor of Arts Degree in Political Science. In 1986, Rebecca graduated from Pepperdine University School of Law where she was the recipient of both the American Jurisprudence Award in Family Law and the Los Angeles County Bar Family Law Scholarship. For the past 9 years, Rebecca has practiced Collaborative Divorce Law and Mediation as a major part of her Domestic Relations law practice. Rebecca has always had a love of the law and courtroom drama. She enjoys fighting for people’s rights and attempting to convince a Judge that her client’s position should prevail. She grew up in a close knit family in Las Vegas and worked in her family’s dry cleaning operation, where she developed a good business sense and excellent people skills by watching her parents make a success of their business. In law school, Rebecca received the highest grade in her Family Law class, which she attributes to her keen interest in people and the fact that she truly cares about the issues of the families whom she diligently and passionately represents.[email protected]

skype.com/rebeccamiller

Serena Baig Cooper

Serena Baig Cooper is an associate attorney with COOPER I COONS, Ltd. Serena works primarily in the areas of estate planning and asset protection. She advises clients as to matters such as retirement planning, business succession, separate property planning, and charitable giving, all as part of an integrated estate plan. Serena is also experienced in trust and probate litigation as well as tax issues with the IRS. Serena received her law degree from Duke University and earned her bachelor’s degree from the University of California, Berkeley. Serena began her career in her hometown of Las Vegas, where she began working as an associate attorney for the law firm of McDonald Carano Wilson, LLP in the areas of civil litigation, probate and trust administration, and estate planning. In 2007, Serena left McDonald Carano Wilson to move to Boston, Massachusetts where she worked full time at the Massachusetts Department of Revenue. As an Appeals Officer for the Massachusetts DOR, Serena conducted hearings with taxpayers and their representatives in order to evaluate and resolve disputed tax matters concerning both federal and Massachusetts individual, corporate, estate, and fiduciary income tax issues. She also attended Boston University School of Law in the evenings and obtained her Master of Laws (L.L.M.) in Taxation with an emphasis in Estate Planning in January, 2010. Having lived in the Dominican Republic for three years with her family, Serena speaks Spanish fluently. She is admitted to practice law in Nevada, California, Massachusetts, and New York.Serena's Publications:

- “Using Living Trusts and Powers of Attorney as Estate Planning Tools,” co-authored with Jeremy K. Cooper, Drafting Effective Wills and Trusts, National Business Institute Continuing Legal Education for Professionals Manual, Copyright 2013.

- “Year-end Estate, Gift, and Generation Skipping Transfer Tax Planning: The End of an Era?,” co-authored with Jeremy K. Cooper, Silver State CPA, December 2012.

[email protected]

skype.com/serena.baig

Thomas Miskey

Thomas Miskey is an associate attorney with COOPER I COONS, Ltd. Thomas works primarily in the areas of estate planning, intellectual property, and quiet title litigation. He protects client’s interests through securing trademarks and patents, clarifying an owner’s title in real estate, and planning for multiple contingencies. Thomas received his law degree from William S. Boyd School of Law and earned his dual bachelor’s degree from Northern Arizona University. A Las Vegas native, Thomas began his legal training in high school, participating in multiple Mock Trial competitions where he secured several awards for mastery of rules of evidence. During his college summers, he worked at John Peter Lee, Ltd., a fast paced civil litigation firm, gaining insight into how courts work. While in law school, he was hired as a law clerk for COOPER I COONS, Ltd, working primarily with trademarks and providing litigation support for quiet title actions. Upon passage of the Nevada Bar, he was accepted as an associate attorney. Thomas enjoys creating custom culinary meals for friends and family. Seldom following a recipe, Thomas will add a little bit of this and a dash of that to create something delicious. The meal doesn’t always turn out that way, much to the dismay of his wife, but he enjoys the experimentation. One more than one occasion, his wife insisted they go out to eat after his experimentation.[email protected]

|

|